Ultimate Guide to DApp Governance Incentives

Decentralized applications (DApps) are reshaping decision-making by empowering communities through on-chain governance. This system uses governance tokens to enable users to propose and vote on changes, with decisions implemented via smart contracts. However, participation often suffers due to low voter turnout and the "free-rider" issue, where many benefit without contributing. To address this, DApps use incentives like staking, voting, and proposal rewards to boost engagement and ensure decisions reflect the community’s interests.

Key Points:

- Governance Tokens: Allow voting on upgrades, treasury management, and more.

- Challenges: Low participation and dominance by large token holders.

- Incentives:

- Staking Rewards: Reward token locking with additional governance benefits.

- Voting Rewards: Compensate for reviewing and voting on proposals.

- Proposal Rewards: Encourage submission of impactful governance ideas.

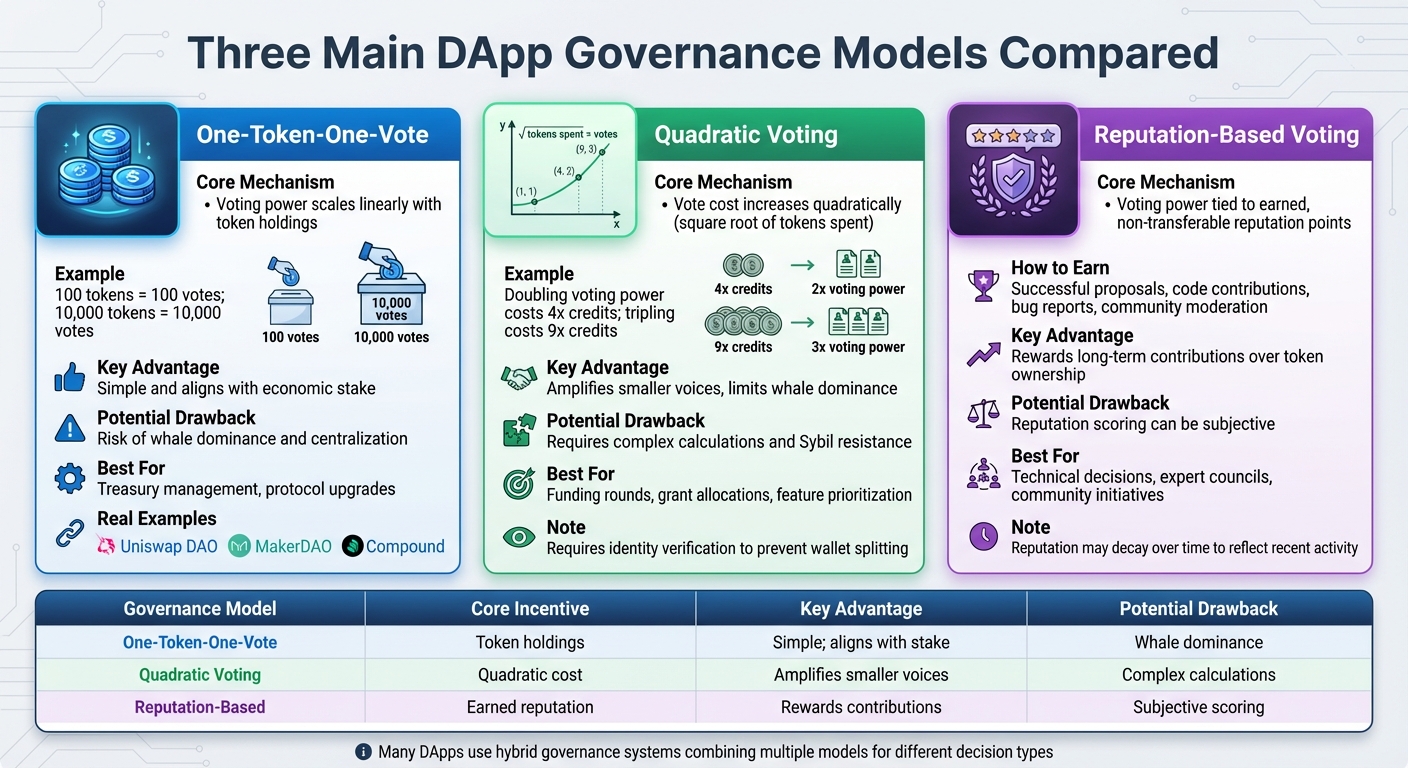

- Governance Models: Include one-token-one-vote, quadratic voting (amplifies smaller voices), and reputation-based systems (rewards contributions over token ownership).

- Best Practices: Transparent token distribution, safeguards against manipulation, and sustainable rewards tied to protocol health.

DAO Governance Explained: How Voting & Proposals Work in DAOs

Main Types of Governance Incentives

DApp governance incentives generally fall into three main categories: staking rewards, voting rewards, and proposal rewards. Each type focuses on a distinct aspect of participation – whether that’s committing capital, making decisions, or taking initiative.

These incentives aim to tackle low participation levels by rewarding users for their time, expertise, and capital. At the same time, they strive to balance financial rewards with the long-term health of the protocol, avoiding unsustainable token inflation. Let’s dive into the details of each reward type.

All figures and time references follow Canadian standards.

Staking Rewards

Staking rewards are designed to compensate users who lock their tokens in a smart contract, helping to support or secure the protocol. In return, stakers earn new tokens or a share of the protocol’s revenue – usually expressed as an annual percentage yield (APY). Additionally, staking often comes with enhanced governance rights, such as increased voting power or the ability to delegate votes.

The structure of staking systems involves several key factors. Lock-up periods encourage long-term commitment but may reduce liquidity, which could be a consideration for Canadian users. Reward rates must strike a careful balance – offering excessively high yields (like triple-digit APYs) might lead to unsustainable inflation, while moderate returns in the single- to low double-digit range help maintain token stability. Some systems also include slashing mechanisms to penalize bad behaviour or inactivity, ensuring participants remain accountable.

To avoid creating a "rentier class" – participants who stake tokens but don’t engage in governance – rewards should be tied to active governance participation. For instance, stakers who vote or delegate could receive higher yields. Additionally, measures like capping voting power for oversized stakes and funding rewards from protocol revenues (rather than unchecked token issuance) can support long-term sustainability.

By aligning individual efforts with the broader well-being of the protocol, staking rewards encourage active and responsible participation.

Voting Rewards

Voting rewards motivate participants to engage in governance by compensating them for casting votes on proposals. This helps reduce voter apathy and ensures token holders, delegates, or representatives are rewarded for the time and effort they invest in reviewing proposals and making informed decisions.

Typical mechanisms include fixed or variable rewards per vote and participation bonuses for maintaining high voting rates across multiple cycles. Some systems also offer delegation incentives, where rewards are shared between those who delegate their votes and the representatives who cast them. This creates a more dynamic and efficient delegation market.

However, the challenge lies in ensuring that rewards encourage informed voting. One approach, like Cardano‘s CPS-0020 proposal, involves retrospectively assessing engagement and impact to distribute rewards meaningfully. Other safeguards, such as quorum thresholds, reputation systems that track voting quality, and minimal effort proofs, can further promote thoughtful participation.

For Canadian users, it’s helpful to display voting periods in local time zones and clarify how rewards might be treated for tax purposes. Expressing potential earnings in CAD-equivalent terms, while accounting for crypto volatility, ensures transparency.

By incentivizing informed decision-making, voting rewards strengthen governance and encourage meaningful engagement.

Proposal Rewards

Proposal rewards are aimed at contributors who take the initiative to design, submit, and implement governance proposals that improve the DApp ecosystem. These incentives focus on encouraging leadership and rewarding those who identify challenges, develop solutions, and drive impactful changes.

The reward structure typically spans multiple stages, from submission and drafting to formal approval, implementation, and post-implementation review. To prevent low-quality or malicious proposals, proposers may be required to stake tokens and undergo a mandatory review process. Setting clear success metrics in advance ensures that rewards are only granted when proposals deliver measurable benefits to the protocol and its community.

Common Governance Models in DApps

DApp Governance Models Comparison: Token-Based vs Quadratic vs Reputation-Based Voting

The governance model you choose for your DApp sets the tone for how decisions are made and incentives are distributed. It determines who holds the most power – whether it’s large token holders, smaller contributors, or long-term participants – and shapes the balance between inclusivity and influence.

Three widely used models are one-token-one-vote, quadratic voting, and reputation-based voting. Each has its own strengths, weaknesses, and ideal scenarios. By understanding these models and how they can work together, DApp teams can design governance systems that reflect their community’s priorities and values.

One-Token-One-Vote

The one-token-one-vote model is straightforward: the more tokens you hold, the more votes you get. For instance, owning 100 tokens gives you 100 votes, while 10,000 tokens grant 10,000 votes. This approach ties voting power to economic stake, assuming that those with more at risk will act in the protocol’s best interest.

Many systems also allow delegation, where smaller token holders can transfer their voting power to trusted representatives. This boosts participation without requiring every individual to evaluate every proposal.

While simple, this model has its downsides. A major concern is whale dominance, where a small group of large token holders – such as early investors or venture capitalists – can control the outcome of votes. This can lead to centralisation, leaving smaller holders feeling powerless and disengaged. For example, Uniswap DAO, MakerDAO, and Compound have all faced scenarios where concentrated token ownership influenced major decisions, sometimes sparking debates about fairness and centralisation.

To address these challenges, DApps can implement measures like voting caps per address, time-based vesting for large holders, or quorum thresholds to prevent apathy or cartel-like behaviour. Token distribution methods, such as airdrops or liquidity mining, can also help spread voting power more evenly. For Canadian communities, offering participation rewards and ensuring accessible token distribution can encourage broader involvement while reducing regulatory concerns.

Quadratic Voting

Quadratic voting is designed to limit the dominance of large holders by making additional influence increasingly expensive. Here, voting power grows with the square root of the tokens or credits spent. For example, doubling your voting power costs four times as many credits, and tripling it costs nine times as much. This system balances the scales, giving smaller participants a louder voice.

In quadratic voting systems, participants are typically given non-transferable voting credits for each cycle. The cost of casting votes increases quadratically, making it harder for large holders to dominate. However, this approach requires robust safeguards against gaming the system, such as splitting tokens across multiple wallets. Effective Sybil resistance mechanisms, like identity verification or reputation layers, are essential.

This model works particularly well for scenarios like funding rounds, grant allocations, and prioritising feature development. It allows participants to express the intensity of their preferences while amplifying smaller voices. However, it may not be ideal for security-sensitive decisions, such as protocol upgrades, where expertise or financial stakes are crucial. For Canadian users, displaying vote costs in CAD and using clear examples (e.g., "9 credits equal 3 votes") can make the process more intuitive and encourage participation.

Reputation-Based Voting

Reputation-based voting shifts influence from token ownership to earned contributions. Instead of relying on tradable tokens, participants gain voting power through non-transferable reputation points. These points are earned by making meaningful contributions, such as submitting successful proposals, writing code, reporting bugs, or moderating the community.

This model rewards long-term contributors over short-term investors, aligning governance power with sustained effort. It also reduces the risk of plutocracy since reputation cannot be bought or sold. Reputation points are typically assigned based on peer reviews, committee assessments, or on-chain validation, and they may decay over time to ensure that governance reflects recent activity.

Reputation-based voting is particularly appealing to open-source and public-sector communities in Canada, where expertise and service are highly valued. It’s especially effective for technical decisions, expert councils, and community-driven initiatives. To ensure fairness, systems often include safeguards like multi-signature reviews or elected councils to validate contributions.

Blending Governance Models

Many DApps now use hybrid governance systems that combine these models. For example, token-based voting might handle high-level decisions like treasury management, while quadratic or reputation-based voting is used for grants or community funding. Some systems even require proposals to pass both token-weighted and reputation-weighted votes, balancing financial stakes with earned expertise.

For Canadian projects collaborating with Digital Fractal Technologies Inc, hybrid models can effectively represent both investment (from corporate or institutional holders) and operational contributions (from developers and public-sector partners). Choosing the right mix depends on your protocol’s goals – capital-intensive projects might lean toward token or expert-weighted voting, while community-focused ones might favour quadratic or reputation-based approaches.

| Governance Model | Core Incentive Mechanism | Key Advantage | Potential Drawback |

|---|---|---|---|

| One-Token-One-Vote | Voting power scales with token holdings | Simple; aligns with economic stake | Risk of whale dominance |

| Quadratic Voting | Vote cost increases quadratically | Amplifies smaller voices | Requires complex calculations |

| Reputation-Based | Voting power tied to earned reputation | Rewards long-term contributions | Scoring can be subjective |

Making Governance Accessible

No matter which model you choose, accessibility is key. Governance interfaces should display voting power – whether in tokens, credits, or reputation – in clear numeric terms, ideally with CAD equivalents for Canadian users. Mobile-friendly designs, step-by-step guides, and real-world examples can make participation easier. For institutional users, features like audit logs and compliance-friendly timelines are essential.

sbb-itb-fd1fcab

How to Design Effective Governance Incentives

Creating governance incentives is all about encouraging meaningful participation while safeguarding the long-term value of the protocol. The idea is to reward actions that genuinely benefit the protocol – like voting on critical upgrades, treasury decisions, or risk parameters – rather than fuelling short-term speculation or token farming. To achieve this, focus on three guiding principles: alignment (linking rewards to the protocol’s health), sustainability (avoiding token emissions that erode value), and inclusivity (ensuring participation from holders of all sizes). With these principles in mind, let’s explore how token distribution can set the stage for strong governance.

Balancing Token Distribution

Fair token distribution is key to healthy governance. Typically, governance tokens are divided among founders, investors, core contributors, community airdrops, liquidity incentives, and treasuries. To prevent concentrated control by insiders, it’s important to cap internal allocations and reserve a significant portion – often 40–60% – for the community through airdrops, grants, and participation rewards. Community allocations should reward meaningful contributions, such as submitting successful proposals, maintaining infrastructure, or providing liquidity, instead of simply holding tokens passively.

For Canadian users, it’s helpful to present clear token distribution charts with Canadian formatting (e.g., 1,000,000 tokens) and detailed vesting timelines. Transparent communication builds trust and allows participants to assess risks related to centralisation.

Preventing Governance Exploits

A secure governance system requires multiple defences against manipulation. Snapshot voting is an effective way to block flash-loan attacks. Introducing a delay – typically 24 to 72 hours – between a vote’s success and its execution gives the community time to identify and respond to suspicious activity. For upgradeable contracts, using audited governance modules and multisignature wallets with emergency pause functions is crucial. Ensure there’s a clear separation between governance, treasury, and protocol logic.

To combat spam and malicious proposals, implement minimum proposal thresholds and deposit requirements, with deposits refunded for successful proposals. Additional safeguards like external security audits, formal verification, and bug bounty programs that focus on governance paths (e.g., treasury transfers, parameter changes, upgrade hooks) are essential. Since governance exploits can compromise an entire DApp, these measures are non-negotiable. Canadian teams can collaborate with partners like Digital Fractal Technologies Inc to integrate these practices into enterprise-grade security frameworks.

Avoiding Inflationary Incentives

To maintain token value, rewards need to be sustainable. Instead of fixed annual rates, consider capped or decaying emissions with a hard limit on total reward tokens. Align rewards with impact by allocating a portion of protocol revenue to active voters rather than endlessly minting new tokens. Non-monetary incentives like reputation systems, role-based access, or public recognition (e.g., highlighting contributor roles or offering early access to beta features) can also motivate participants without inflating the token supply.

For governance staking, consider incorporating penalties like slashing or withholding rewards for malicious behaviour, ensuring safety and alignment with the protocol’s goals. Regularly review token-economic models – using CAD-denominated models for Canadian stakeholders – and adjust reward levels quarterly to prevent inflation from devaluing tokens.

Tracking the Effectiveness of Incentives

To determine if your incentive design is working, monitor key metrics like participation rates (e.g., voter turnout percentage, unique voters per proposal), distribution metrics (e.g., ownership concentration, percentage held by top 10 holders), and outcome quality (e.g., proposal success rates, post-change protocol performance, treasury spending efficiency). Set clear benchmarks – for example, aim for at least 10–20% turnout on high-impact proposals or limit the top 10 holders to 30–40% of voting power.

Supplement on-chain data with off-chain insights like forum discussions, sentiment analysis, and contributor surveys. These tools can provide early warnings and help fine-tune incentives to ensure the governance system remains effective and fair.

Examples of DApp Governance Incentives

These examples highlight how carefully designed incentives can encourage governance participation and align community goals with the broader growth of a protocol. Let’s explore three noteworthy cases – Aave Grants DAO, MetaCartel Ventures, and Optimism’s Retroactive Public Goods Funding – each showcasing unique strategies for driving engagement and aligning interests.

Aave Grants DAO

Aave Grants DAO (AGD) is a community-led initiative funded by Aave governance to support projects that enhance the ecosystem. Initially launched in 2021 with a budget of approximately US$1 million, AGD has since received additional funding due to its success. The DAO provides grants for a variety of initiatives, including infrastructure, community projects, tooling, and research. In its early stages, AGD funded over 60 projects, allocating a low-seven-figure USD equivalent in AAVE tokens and stablecoins.

The process is structured to ensure quality: proposals are vetted, discussed within the community, and voted on. Approved grants are released in milestone-based payouts, and recipients face penalties for failing to meet agreed-upon goals. Thanks to this structure, proposal submissions increased by over 30%, and voter turnout improved significantly, with measurable results driving further participation.

While Aave focuses on grants, other DAOs adopt investment-oriented models.

MetaCartel Ventures

MetaCartel Ventures (MCV) operates as an investment DAO, structured as a Delaware LLC. Members pool capital and share profits through carried interest, typically 20% on exits. This model ensures participants have a vested interest in the outcomes, as members contribute substantial capital in exchange for voting shares. Governance incentives include profit-sharing from successful investments, rewards for voting on grant applications, and enhanced reputational standing within the community.

MCV employs innovative mechanisms like quadratic funding to prevent dominance by large stakeholders and conviction voting, where sustained support increases vote weight. These strategies have enabled investments in over 50 Web3 projects, including early-stage successes like Roll, which generated significant returns shared via treasury distributions. Participation is further boosted by retroactive token airdrops for voters, processing over 1,000 signals annually and fostering active engagement.

Another distinctive approach is Optimism’s retroactive funding model.

Optimism Retro Funding

Optimism’s Retroactive Public Goods Funding (RetroPGF) rewards contributors based on proven results rather than speculative promises. Through quarterly rounds, the Citizens’ House allocates OP tokens from the governance treasury. For example:

- Round 1 (2021): Distributed 1 million OP tokens to 58 projects.

- Round 2 (2022): Scaled up to 10 million OP tokens for 195 recipients.

- Round 3 (Q4 2023): Allocated 30 million OP tokens to over 500 projects.

By 2025, the program had distributed over US$300 million, with funded projects reporting a 5x average growth in usage metrics. This model has driven a 40% increase in voter participation quarter-over-quarter, thanks to badge incentives and quadratic voting, while encouraging developers to focus on impactful contributions without needing upfront guarantees.

For Canadian teams developing governance systems, these models provide actionable blueprints: treasury-backed grants for direct rewards (Aave), quadratic and conviction voting to balance influence (MetaCartel), and retroactive rewards to sustain engagement (Optimism). When presenting token budgets to Canadian stakeholders, it’s helpful to include CAD-equivalent values (e.g., 1,000,000 tokens ≈ $2,500,000 CAD) and consider fiscal year timelines. Additionally, integrating governance tools and analytics – perhaps by collaborating with firms like Digital Fractal Technologies Inc – can help track metrics and automate transparent incentive distribution, ensuring governance remains fair and merit-driven.

Conclusion

As explored earlier, staking, voting, and proposals are the pillars of effective DApp governance. The key to success lies in creating incentives that encourage active participation, long-term stability, and protection from vulnerabilities. Lessons from successful DAOs highlight a straightforward principle: reward actions that truly strengthen the protocol – like well-considered proposals, informed voting, and meaningful contributions – while discouraging spam, dominance by large token holders, and short-term manipulation. Staking rewards, voting incentives, and proposal grants should align with measurable outcomes rather than token holdings or sheer activity levels.

To implement these ideas, governance treasuries must be carefully managed. Model reward systems based on annual treasury inflows, set limits on token issuance, and simulate the effects over several years to prevent inflation that could devalue the ecosystem. Cardano’s CPS-0020 governance proposal underscores this approach: incentives should come from stable treasury revenues rather than arbitrary token creation, ensuring stakeholders are rewarded fairly without destabilizing the system’s foundation.

Encouraging high-quality proposals and steady participation can be balanced with deterrents like slashing mechanisms, proposal bonds, or timelocks to reduce the risk of malicious behaviour or rapid exploitation. Tools such as quadratic voting, delegation, and reputation-based weighting can help distribute influence more evenly, preventing governance from being dominated by large stakeholders while maintaining accessibility. A good example is Alaya/PlatON‘s governance fund, which uses pre-programmed, parameterized rewards with adjustable ratios and unlocking schedules embedded in smart contracts. This approach provides clear, predictable incentives that align with the protocol’s goals.

FAQs

What role do staking rewards play in encouraging participation in DApp governance?

Staking rewards are a key factor in getting users involved in DApp governance by offering real, measurable benefits. These rewards motivate token holders to actively participate in decision-making, boosting community involvement and supporting decentralization.

By tying individual benefits to the broader goals of the platform, staking creates a system where participants are not just financially invested but also dedicated to the platform’s long-term growth. This approach helps build a stronger, more engaged governance structure.

How can DApps ensure fair governance and prevent dominance by large token holders?

To ensure fair governance and prevent a few large token holders from overpowering decision-making in DApps, several strategies can be employed:

- Quadratic voting: This method adjusts voting power, giving smaller stakeholders a stronger voice and helping to create more balanced results.

- Voting thresholds: Decisions can be made contingent on meeting a minimum level of diverse participation, ensuring a broader range of voices is heard.

- Token-weighted voting with caps: By setting limits on how much influence a single entity can wield, this approach promotes a more balanced and inclusive system for all participants.

Carefully designed governance structures can help DApps foster wider community involvement while upholding fairness and openness.

What advantages does quadratic voting offer to smaller participants in DApp governance?

Quadratic voting enhances participation in DApp governance by giving smaller stakeholders a stronger voice based on their level of engagement. This approach helps prevent larger players from overpowering decisions, creating a governance process that feels more balanced and inclusive.

By focusing on the collective input rather than just financial power, quadratic voting motivates wider community involvement and promotes fairer decision-making within decentralised applications.